Why Is the Housing Market So Sluggish?

There is a critical shortage of homes causing a weak housing market. Sales of pre-owned homes dropped 3.3% in June from May, and 18.9% lower than from June of 2022. While a six-month supply is considered balanced between buyer and seller, the current sales represent only a 3.1-month supply. Pricing of homes has still held firm, with the median price of an existing home sold in June was $410, 200, the second highest price ever recorded by the National Association of Realtors. So, pricing remains high with supply low.

How did the shortage occur?

The issue of supply and demand in the housing market arose prior to the pandemic. In short, the United States simply did not keep up with the housing demands of our changing population. Then when the pandemic occurred, the housing market experienced supply chain issues, labor shortages, and rising materials costs, increasing the time for the delivery of new homes. Most recently, the housing supply is also affected by increased mortgage rates and inflation. At interest rates currently hovering at 7%, homeowners may not wish to sell their home, especially if they locked into a lower rate. Also, these homeowners may not be able to afford the price of a new home if they need to obtain a mortgage to purchase their next home. As a result, potential home sellers are staying put, decreasing the number of homes for sale. Further, normally when someone sells their home, they buy another home. That is not always happening here.

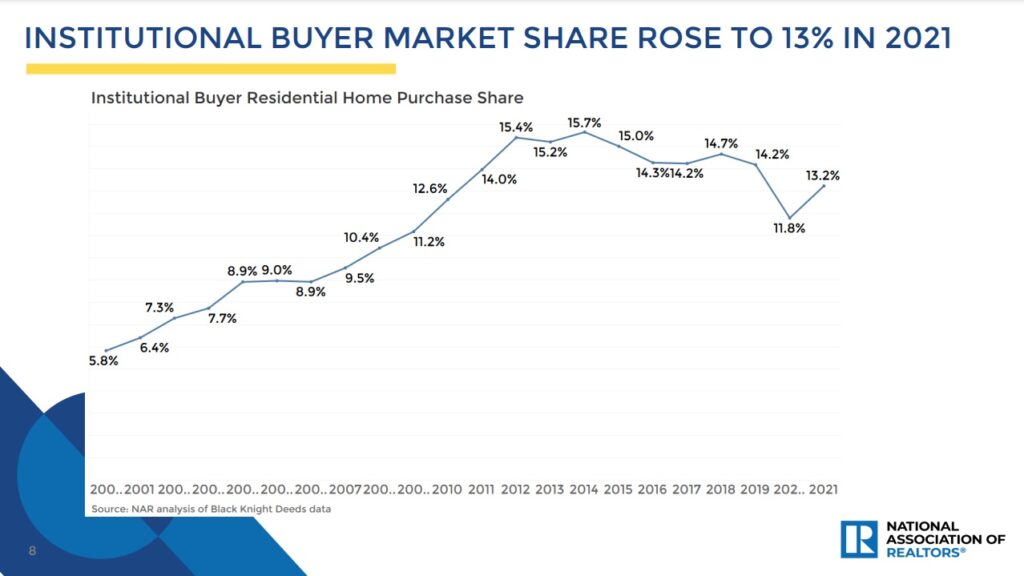

Another factor that exacerbates the housing shortage is the number of institutional investors who buy a substantial portion of the housing inventory for profit. According to 2022 a National Association of Realtors study, investors accounted for more than 13 % of all residential real estate purchases in 2021, removing those properties from the available individual buyer pool. These buyers are either renting out their houses or turning them into vacation rentals and Airbnbs, further reducing the housing stock for permanent households.

What is the effect of a housing shortage?

With short supply, there are fewer buyers of residential real estate except for cash buyers. More demand has led to multiple offers on homes, making the sale price over the list price. As competition for homes increases, buyers who are able are using cash to secure the contract. With over asking price and ample cash buyers, many buyers are left to find other properties which may again have multiple offers, and other cash buyers.

What is the solution to our housing shortage? Simply put, more homes need to be built, office buildings and malls need to be converted to housing and zoning laws need revisiting.

As a result of a slow existing home market, sales of newly built homes are actually reaping the benefits. DR Horton, the nation’s largest homebuilder, reported a 37% increase in new orders from the prior quarter.

What does this all mean?

As we have discussed in past blogs, low inventory, high inflation, and increased mortgage rates have softened the existing real estate market. More supply will lead to more availability for home buyers and will result in stable pricing. While new construction is providing more homes in the market, we still may experience a sluggish market until such time as interest rates lower, so homeowners are able to refinance or sell their homes and buy a new home, and first-time home buyers are able to enter the market with attractive mortgage rates.

Roy Oppenheim

From The Trenches